The cost of energy and aeroplane tickets pushed household prices higher in the opening month of 2020, official statisticians have revealed.

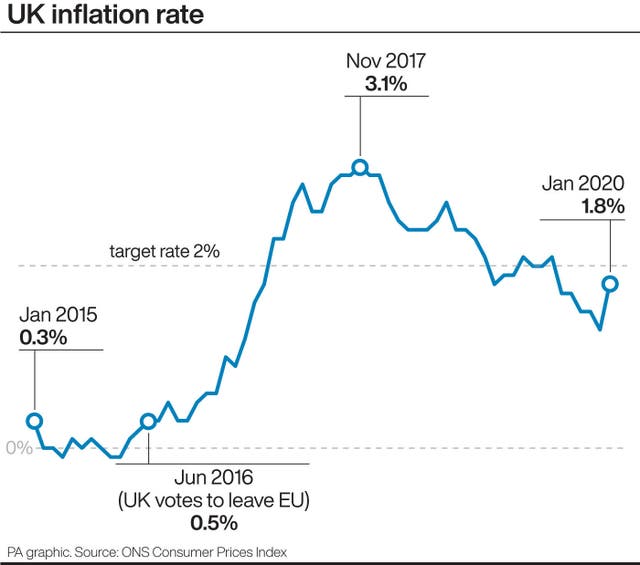

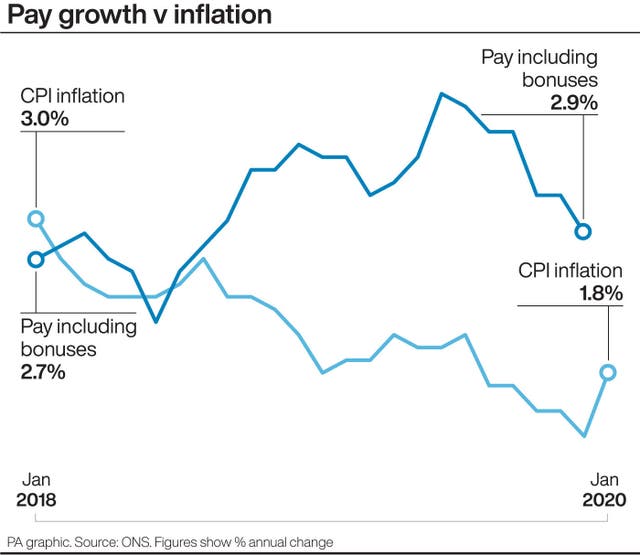

The Office for National Statistics (ONS) said the rate of the Consumer Price Index (CPI) increased to 1.8% in January, up from 1.3% the month before. It is the highest inflation has been for six months and ahead of the 1.6% that experts were predicting.

It means that prices for a basket of goods that average UK households buy has increased faster than expected.

The CPI is measured against January last year, when the cost of flying was falling, and the Government’s energy price cap had just come into effect, putting downward pressure on household bills.

“The rise in inflation is largely the result of higher prices at the pump and airfares falling by less than a year ago. In addition, gas and electricity prices were unchanged this month, but fell this time last year due to the introduction of the energy price cap,” said Mike Hardie, the ONS’s head of inflation.

Energy regulator Ofgem introduced the first cap on energy bills on January 1 last year, promising savings for many customers. The introduction meant that the average household on a default energy tariff could be charged no more than £1,137 per year for their gas and electricity.

However, Ofgem faced criticism just over a month later as it announced that the cap would be raised in April by £117 to £1,254, wiping out all of the promised savings. The cap is reviewed every six months.

The ONS showed that the price of electricity had increased by 8.6% compared to 12 months ago.

The price of petrol rose by 2.3p to 126.9p per litre in January.

The news will be seen by many as vindication for the Bank of England committee that decided to keep the bank’s rate flat earlier this year. Analysts had speculated that the bank might slash rates after inflation dipped to 1.3% in December, from 1.5% in both October and November.

“The rise in both core and headline measures of inflation vindicates the Bank of England’s decision to keep interest rates on hold in January. Further rises would significantly reduce the chances of a rate cut in the near future,” Debapratim De, senior economist at Deloitte, an auditor.

CPIH, the measure which includes housing costs, was also 1.8% in January, up from 1.4% in December.

The Retail Price Index (RPI), which is used by the Government to set train fares, was 2.7% in January, up from 2.2% in December.

The price of communication products and services increased by 4.2% compared with 12 months earlier.

Meanwhile, the cost of oils and fats dipped 11.2%, while the cost of fuels and lubricants for transport rose by 4.7%, and book prices rose 6.1%.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here